Lessons from Chris Ellis, CEO and Co-Founder of Thatch, on Modernizing Health Benefits

Subscribe to our substack for updates and listen on Apple Podcasts or Spotify. Connect with Andrew if you find this post insightful and want to learn more.

Welcome back to the Pear Healthcare Playbook! Every week, we’ll be getting to know trailblazing healthcare leaders and diving into building a digital health business from 0 to 1.

We're excited to introduce Chris Ellis, CEO of Thatch. With a background in cancer research and clinical software, Chris brings a unique blend of scientific rigor and product vision to one of the most complex challenges in the United States: healthcare. Under his leadership, Thatch has scaled quickly, now serving over a thousand companies and helping employees navigate their health coverage through a modern, fintech-powered experience.

If you prefer to listen:

The Founding Story of Thatch

Chris Ellis was just six years old when his father died from cancer. That early loss left a lasting imprint and instilled a skepticism about how the healthcare system currently works with an aspiration to how it could work.

“I actually think we don’t have as many entrepreneurs in healthcare today because how could you want to disrupt something you venerate or hold in such high esteem? Sometimes, having a bad experience early on opens up a window to question the things we take for granted.”

Chris began his career in cancer research, driven by his father’s story. But even in the lab, he was thinking about scale. That curiosity pulled him into startups, first at a company selling software to molecular labs, then to Agilent, a global biotech firm. It was there that he met Adam, whose unusual background included experiences at both Humana and Stripe. Chris saw him as the rare bridge between healthcare and fintech and reached out to him via email.

They began emailing back and forth and quickly discovered a shared ambition to build something in healthcare. Both had lost parents to cancer and were thinking deeply about how to make the system better. What started as a few exchanges turned into lengthy, dense threads filled with product ideas, research, and reflections on what healthcare could look like if reimagined around the consumer. They even took a trip to the mountains of Utah to walk and talk through their thoughts. While they didn’t know exactly what form their company would take, they knew they wanted to build it together.

Initially, they explored building tools for cancer patients, based on Chris’s experience helping oncologists match patients to clinical trials. The idea was to make that technology available directly to patients, especially those outside major academic centers. If patients could access trial information on their own, they might be able to find better treatment options and advocate more effectively for their care.

To test the idea, they posted in online forums like Reddit asking to speak with cancer patients and offering gift cards in exchange for conversations. These were not just quick surveys. They spent real time hearing about people’s care experiences, frustrations with the system, and what they wished had been different.

Some patients were interested. But most were not looking for new clinical tools. They trusted their oncologists and did not see a startup as part of their care team. What they did talk about, again and again, was how frustrating and expensive it was to pay for care. Denied claims, confusing bills, insurance companies refusing coverage even for their long term members were the pain points they kept returning to.

At the time, Chris and many of his teammates who were early hires of the company were also experiencing issues with insurance.

“The week I left my job to start the company, I tore my Achilles. I got surgery and did all the things, and then showed up for physical therapy. But they turned me away because the insurance company had clawed back the charges and said I owed them $20,000. I couldn’t go to PT. And all of this was happening while we were hiring employees, raising a little bit of money from friends and family, and getting set up with health insurance for the business.”

As the company grew, Chris and Adam ran into problems managing health insurance for their early employees. They had selected a group plan based in Austin, where Chris lived, but it didn’t work for everyone. One employee strongly preferred Kaiser and said it was the only insurance he had ever liked. Another, based in New York, found that the plan didn’t cover any of his doctors, including his primary care physician of twenty years. Employees were frustrated. They were spending thousands of dollars on a benefit that didn’t meet their needs.

A few months later, while they were in the process of switching to a new plan, things got worse. Chris was on a rare vacation with his mother, who had just retired. While abroad, he received texts from employees saying they couldn’t pick up prescriptions or see their doctors. It turned out the insurance had lapsed during the transition. Chris had to wake up at 3 a.m. to call the insurer and get coverage reinstated. All the while, they were hiring employees, raising money, and trying to focus on building the company.

These frustrations echoed what they had heard from patients during their earlier clinical research. People repeatedly said that the worst part of healthcare was paying for it. Denied claims, confusing networks, and lack of transparency were consistent themes. That feedback sparked a core insight: if you could reorient the healthcare system around the consumer, you could build something people actually liked.

While searching for solutions, they came across a relatively new regulation: the Individual Coverage Health Reimbursement Arrangement, or ICHRA. Created through federal rules finalized in 2019, ICHRA allows employers to offer a tax-free allowance that employees can use to purchase their own health insurance. Instead of forcing everyone into the same group plan, each employee could choose the coverage that fit them best.

It was exactly what they were looking for. The model gave employees choice and allowed the company to stop trying to manage a one-size-fits-all plan. But implementing ICHRA was a logistical headache. It required sending employees to multiple insurer websites, paying premiums out of pocket, and submitting reimbursement paperwork through payroll. For a small company, the process was inefficient and burdensome.

Chris and Adam realized this was not just a healthcare issue, it was a financial infrastructure issue. Their team came from Stripe, Robinhood, Shopify, and Ramp. They knew how to build modern fintech tools. With that background, they believed they could solve the problem not just for themselves, but for other companies too. That realization laid the foundation for what would become Thatch and the company was founded in 2021.

Building Thatch and Finding Product Market Fit

Thatch was founded in 2021, but it was not until late 2022 that the team fully understood the depth of the problem they were trying to solve. They spent that time studying both the employer and employee experience. Only after that did they commit to building a solution centered on ICHRA. It took nearly two full years before their platform was live in the market, around mid to late 2023.

Bringing Thatch to market required careful sequencing and deep integration across a wide range of players.

1. Focus with the Employee

Thatch began by designing for the consumer, the person using the health insurance. Employees needed a simple way to compare and select plans that matched their needs, whether they prioritized affordability, mental health services, or local provider access. Thatch focused on making the experience intuitive and supportive from enrollment through reimbursement.

2. Build for the Employer

Many businesses wanted more control over benefit spending, easier setup, and reduced administrative complexity. Thatch built tools to help employers offer ICHRA with confidence, enabling them to define eligibility, set budgets, and manage benefits without needing to administer a full group plan.

3. Unlock Distribution through Brokers and Payroll Providers

To scale, Thatch had to reach employers of all sizes, especially those with over 50 employees. That meant working with the ecosystem including brokers, benefits advisors, and payroll providers. These intermediaries often shape benefit decisions and handle compliance. Thatch developed broker-friendly workflows and incentives to bring them on board and integrate into existing distribution channels.

4. Secure Insurance Plan Access through Carriers

ICHRA only works if employees have good plan options. Thatch needed to partner directly with insurance carriers to offer a broad range of individual market plans. These partnerships allowed them to embed plan information directly into the platform and ensure users had access to quality coverage across different regions.

5. Build the Financial Infrastructure

ICHRA is not just a health benefits product but also a financial product. Managing tax-free reimbursements and employer contributions required secure and compliant infrastructure. Thatch partnered with banks and built internal systems to handle payments, track expenses, and maintain regulatory compliance.

By the time they launched in late 2023, Thatch had built a system that worked across all these layers. The investment paid off. During open enrollment, demand surged and they onboarded more than 100 paying companies within a few months. While they had to troubleshoot in real time, the product held up. It was functional, compliant, and met real user needs.

How Thatch Provides Value to its Customers

Healthcare is becoming one of the most significant expenses for both individuals and employers. According to the 2025 Milliman Medical Index:

The average cost of healthcare per person is now $7,871, a 6.7% increase from last year.

For a family of four, annual healthcare costs have grown nearly threefold—from $12,214 in 2005 to over $35,000 in 2025.

Outpatient facility care jumped from $3,704 to $9,876 annually.

Pharmacy costs increased from $1,785 to $5,954 per year.

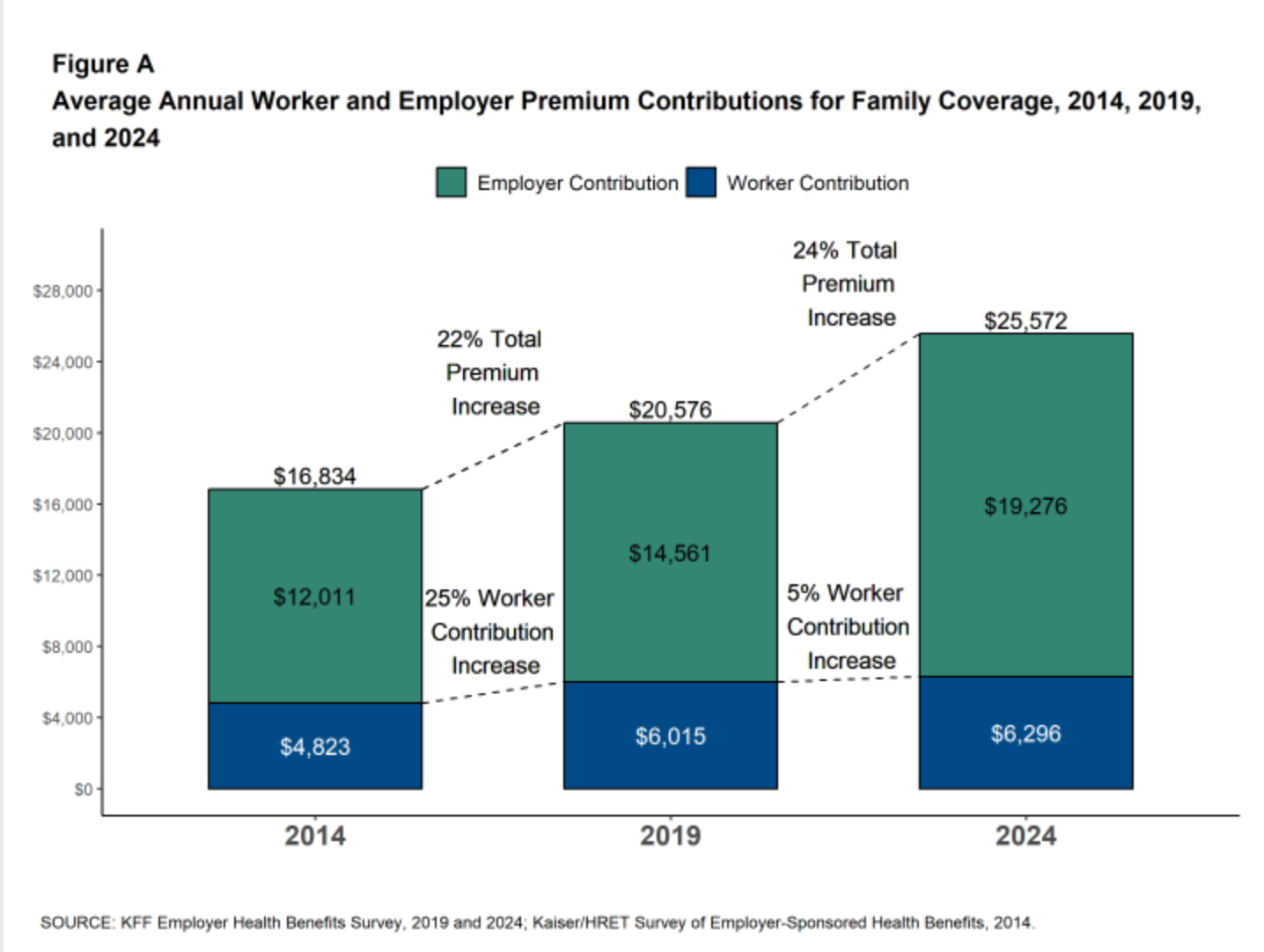

At the same time, employers are being asked to contribute more, and so are employees. Many companies, especially small and mid-sized ones, are facing renewal rate increases of 10 to 25 percent, pushing them to look for alternatives that don’t compromise on care

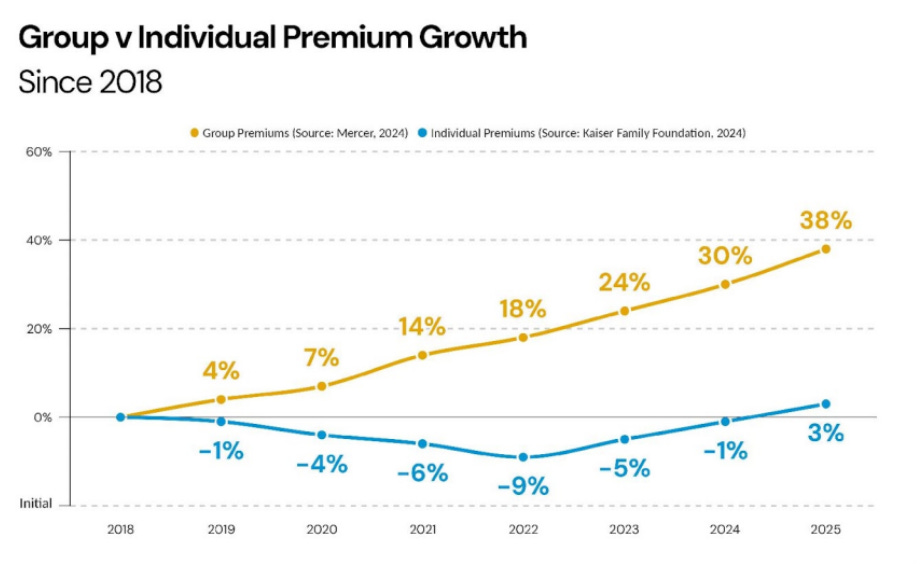

Beyond rising costs, workforce dynamics have changed. The shift to remote work has made traditional group health plans harder to manage. At the same time, ACA marketplace enrollment has grown from 12 million to 21 million between 2020 and 2024(source), and major carriers are investing in ICHRA-based offerings. These tailwinds are accelerating interest in more flexible, employee-centered benefit models.

Thatch helps businesses adapt to this new reality. Instead of managing insurance plans internally, companies can use Thatch to offer personalized benefits that fit modern teams. Today, 80–85% of Thatch customers have fewer than 1,000 employees, with a mix of small and mid-sized businesses choosing the platform to reduce complexity, control costs, and give their employees real choice.

Small Businesses (Under 100 Employees):

For many small employers, Thatch solves a basic but critical problem: they are often too small to even get a quote for traditional group health coverage. With Thatch, these companies can offer health benefits for the first time, without facing high administrative overhead or unpredictable renewals. The platform allows them to set up a plan in under ten minutes, avoid complex management, and control their budget with fixed monthly contributions per employee. In 2024, many small businesses are facing 20 to 25 percent increases in premium costs, with average renewals rising above 10 percent. Thatch gives these businesses a way to stay within budget while still offering competitive benefits.

Mid-Market Companies (100 to 1,000 Employees):

These employers are often looking to improve the experience for their employees while also managing cost. Many founders and HR leaders do not want to be in the business of picking health plans for everyone. Thatch empowers them to give that choice to their team. Employees can select plans that fit their own doctors, prescriptions, and health goals. The platform handles the complexity behind the scenes, offering a user-friendly experience that reduces internal workload and improves employee satisfaction.

Larger Companies (Over 1,000 Employees):

Thatch also works with larger groups, although the value proposition becomes more focused on optimizing between price and coverage. These employers are often used to the group model and may initially feel skeptical about giving employees plan choice. Thatch helps guide them through that transition with benchmarking, education, and tools to ensure the offering is competitive. For these customers, the innovation lies not just in offering ICHRA but in providing a marketplace experience that makes plan selection intuitive and data-informed.

Empowering Employees with Real Choice

A core part of Thatch’s mission is to help employees navigate healthcare confidently. Some users have specific doctors or prescriptions they want covered. Others want guidance on the most affordable and reliable plan available. Thatch helps employees compare options based on their needs and provides a simple, personalized experience.

Chris and the team are clear on one thing: the idea that consumers cannot choose plans for themselves is outdated. Tens of millions of Americans already do this through ACA marketplaces, Medicare Advantage, and Medicaid. What has been missing is the technology and support to make that process easier which Thatch helps to address.

Future of Thatch for 2025

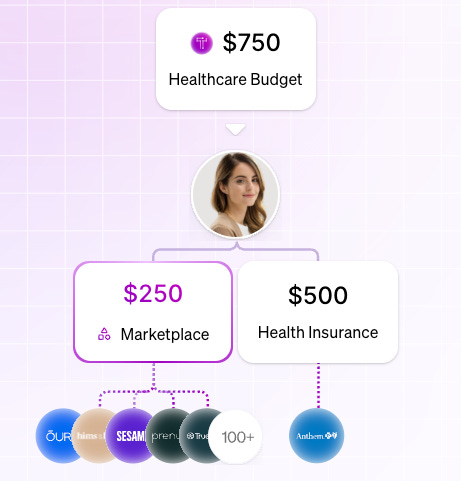

Looking ahead to 2025, Thatch is leaning into one of the most exciting parts of its platform: the marketplace. While the company initially focused on helping employers provide flexible health insurance through ICHRA, the team quickly realized the defined contribution model opened up a much bigger opportunity.

Most employees on Thatch holding an average of $250 in leftover funds each month, which leads to a clear path to let them spend those dollars on more than just insurance. Over time, that adds up to thousands of dollars per year which is enough to access real, meaningful healthcare services and products. That insight became the foundation for the Thatch Marketplace.

The marketplace connects employees to a curated selection of digital health products, services, and tools. These range from therapy and GLP-1 medications to fertility care and wellness offerings from brands like Hims & Hers and Oura. Many of these services were previously only available to employees at large, self-insured companies. Thatch is changing that by opening access to small and mid-sized businesses that typically wouldn’t be able to contract directly with point solutions.

The impact of this strategy goes beyond just giving employees more choice. It also gives digital health companies a new distribution channel. Instead of trying to sell to Fortune 500 employers or wait years for a payer partnership, companies can reach new customers directly through Thatch. If the platform continues to scale, the team believes entire digital health companies could build their go-to-market strategy around it, freeing them up to focus on product development while Thatch handles distribution.

Thatch sees this model as a way to flip the benefits paradigm. Today, most startups or small businesses can’t match the benefits offered by companies like Google. But with Thatch, that could change. If a startup is willing to fund its defined contribution program more generously than a legacy employer, it could actually offer a more personalized, higher-value benefits experience.

The team has already seen early evidence of this shift. High-profile founders launching new AI startups in Silicon Valley have turned to Thatch with a simple ask: help us offer better benefits than Big Tech. While that’s a tall order in the traditional employer-sponsored insurance model, Thatch’s flexible structure and access to premium services make it possible.

Policy Implications for Thatch

Building a healthcare company always involves policy exposure. Health insurance is tightly regulated, and the rules are constantly evolving. While early versions of the legislation offered meaningful upside for ICHRA-focused companies, the final passage of the One Big Beautiful Bill Act (OBBB) in July 2025 ultimately excluded many of those favorable provisions.

Key ICHRA Proposals That Did Not Make It Into the Final OBBB:

Rebranding ICHRAs as “Custom Health Option and Individual Care Expense (CHOICE) Arrangements”

Codifying existing ICHRA regulations (with modifications) into statute

Requiring ICHRA contributions to appear on employees’ Form W-2

Allowing employees to use pre-tax cafeteria plans to pay premiums for Exchange-based individual coverage

Creating an employer tax credit for offering an ICHRA

Despite this, the policy environment remains relatively stable for Thatch:

The regulatory foundation for ICHRAs remains intact via the 2020 rules issued during the Trump administration.

The growth of individual market enrollment and ongoing affordability gaps in small group coverage continue to make the ICHRA model attractive for certain segments.

The removal of proposed tax credits or codification may delay some employer adoption, but Thatch’s differentiated infrastructure and operational flexibility position it well to serve early adopters and evolve with future legislation.

In the meantime, the broader OBBB provisions, like expanded HSA access and increased dependent care FSA limits, reflect continued federal interest in portable, consumer-directed benefits, which philosophically align with Thatch’s model. As the policy landscape evolves, Thatch is well positioned to capitalize on future legislative efforts that reintroduce or revive favorable ICHRA provisions.

Interested in Thatch? Learn more on their Website and LinkedIn

A note from our sponsor: Banc of California

Looking for guidance, connections, resources, opportunity? Banc of California’s banking products and services are built to support your evolving needs as you navigate the challenges of growing a successful business. As you continue to scale, our team will be with you every step of the way. Ready to take your business to the next level? Learn more:

https://bancofcal.com/